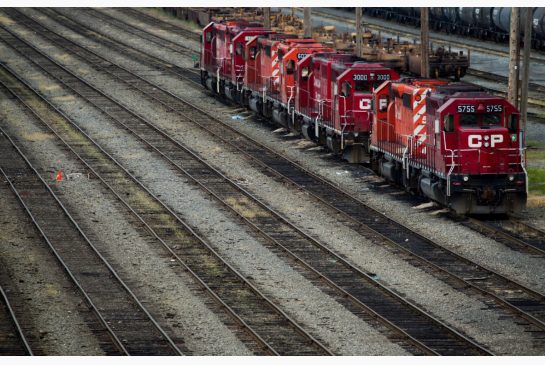

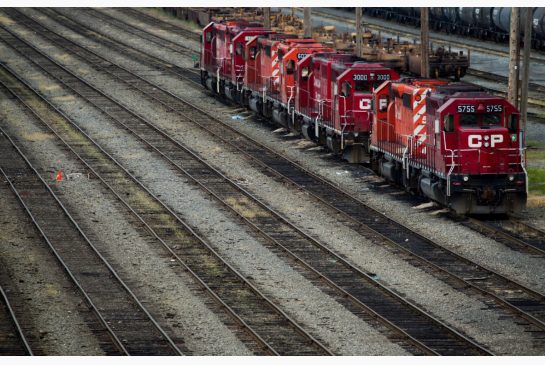

CP asks US DOJ to review Class I execs' opposition to proposed merger

CP asks US DOJ to review Class I execs' opposition to proposed merger

Canadian Pacific Railway plans to cut 1000 positions

CP asks US DOJ to review Class I execs' opposition to proposed merger

CP asks US DOJ to review Class I execs' opposition to proposed merger

Dillon Hess

|

27 January, 2016, 03:59

Recommended

- Double withdrawal hits UFC 196

- Serena Williams beats Sharapova; Federer advances to semis

- Will Super Bowl ticket prices set a record?

- Super Bowl: Panthers' Davis has surgery, Broncos are wearing white

- Lexington mayor running against Rand Paul for Senate

- Australian Open: Serena beats Sharapova, cruises into semifinals

- A movie studio dedicated to VR — Samsung's Sundance surprise

- Estimates Under Spotlight: SBA Communications Corporation

- We're Wolves: What We Do in the Shadows Getting Werewolf Spinoff

- Analyst Review Alert: Liberty Property Trust

- Cheniere Energy Partners LP Holdings, LLC Analyst Rating Update

- New strain of dog flu found in more than 24 states

- Three Whales Wash Up on Skegness Beach, UK

- Stephane Dion says Iran sanctions not good for Montreal's Bombardier

- Quinnipiac Poll: Trump, Cruz Neck-And-Neck In Iowa

Trending Now

Dont Miss

Popular destinations

- Best Non Gamstop Casino

- Non Gamstop Sites

- Casino Not On Gamstop

- Casino Not On Gamstop

- Casino Online Non Aams

- Non Gamstop Casinos

- Sites Not On Gamstop

- Non Gamstop Casinos Uk

- Sites Not On Gamstop

- Non Gamstop Betting Sites

- Best Online Casino Canada

- Online Casinos Not On Gamstop

- オンラインカジノ 一覧

- Mejores Paginas De Poker

- Gambling Sites Not On Gamstop

- Casinos Not On Gamstop

- UK Casinos Not On Gamstop

- Non Gamstop Casino Sites UK

- Slots Not On Gamstop

- UK Online Casinos Not On Gamstop

- UK Casino Not On Gamstop

- Meilleur Casino En Ligne France

- Meilleur Casino En Ligne

- Casino Not On Gamstop

- Bookmaker Not On Gamstop

- Casino Non Aams

- Meilleur Casino En Ligne Belgique

- Jeux Casino En Ligne

- Casino Online Esteri

- カジノ 仮想通貨

- Casino Live

- I Migliori Siti Poker Online

- Casino En Ligne Avis

- Migliori Casino Non Aams

- 코인카지노

- Casino En Ligne Français

- Nouveaux Casino En Ligne

- Casino En Ligne France

- Casino En Ligne France