Saturday morning. Talk less of professionally, hopefully Manziel lands on his ...

Saturday morning. Talk less of professionally, hopefully Manziel lands on his ...

Celtic deny McGeady bid but pave way for Stokes exit

LeBron James' marketing agency parts ways with Johnny Manziel

Saturday morning. Talk less of professionally, hopefully Manziel lands on his feet as a man before..."

82-year-old grandmother killed in brutal attack in the UK

Mamata Banerjee woos captains of industry at Bengal global business summit

French police shoot man attempting to enter Paris' Goutte d'Or station

Rob Gronkowski, Stephen Gostkowski 1st-team AP All-Pro's

Obama tears into National Rifle Association over gun control

Obama tears into National Rifle Association over gun control

The announcement came from Netflix CEO Reed Hastings during the first official day of CES 2016 i..."

Differential pricing violates net neutrality, says IAMAI

Constellation tops Q3 estimates, to build $1.5 billion brewery

Azim Premji 'Most Generous Indian' for Third Year Running

Calvin Ridley's younger brother will play for Kirby Smart at Georgia

Great idea for horror film gets lost in 'The Forest'

Corps expects to open spillway to divert river water

Kane wants to stay at Tottenham - Pochettino

Harry Kane is one of the best strikers in Europe or in the world", Pochettino was quoted as sayi...

Win Big from Home: Your Guide to the Top 10 Online Casinos

In the digital age, the world of gambling has undergone a significant transformation, bringing the thrill and excitement of casinos right to your doorstep. As mentioned in トップ10のオンラインカジノ article, if you're seriously into gaming, it's crucial to know where to find the best gaming experiences and maximize your chances of winning big, all from the comfort of your own home.

Recommended

EFCC Raids Former Customs Comptroller General's Residence

Chinese markets open higher after day's suspension

China's short-lived stock circuit breaker , scrapped after only four days, demonstrates the Communist Party's enduring distrust of the markets and it...

Wall Street quakes as China worries persist

Angus Nicholson, market analyst at IG in Melbourne, Australia said the sell-off this week only underlines that the Chinese government's intervention p...

Economy Adds 292000 Jobs In December

The unemployment rate hasn't been below that mark since 2007. Average hourly ...

Macy's Plans to Cut About 3000 Jobs

Retail consultant Jeff Green, president of Jeff Green Partners, said some shoppi...

British lawmakers to debate call for Trump to be barred

The British government said Home Secretary Theresa May has the power to block no...

Entertainment

Netflix internet TV network available in Serbia

Differential pricing violates net neutrality, says IAMAI

Just 252 million of the more than 1.3 billion who live in India have access to internet, which makes it a huge growth market for companies such as ...

Callaway Cranks Out The 2016 SC600 Chevy Camaro

If you can not wait for more power from a factory performance model from Chevrolet and the sixth-generation Camaro, Callaway is here, and ready to co...

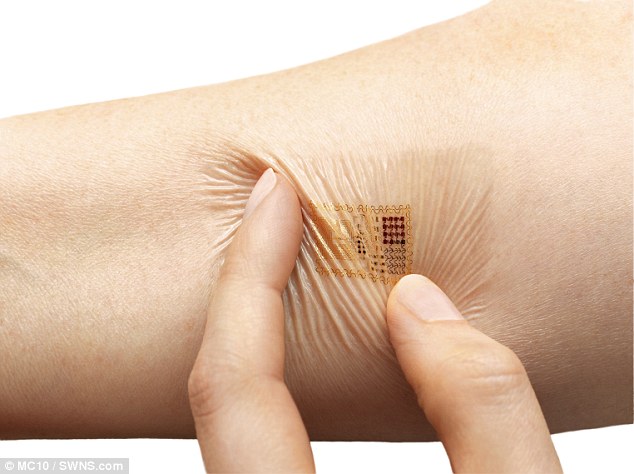

L'Oreal Unveils Stretchable Skin Sensor To Help Monitor Sun Exposure

It can be worn for several days, and according to Tech Crunch , it's free. S...

Samsung posts 5.1 bn profit in Q4 2015

The firm said revenue likely rose 0.5 percent to 53 trillion won. The final re...

Welcome to the World, Roy Batty!

Today is the day that fearsome replicant leader Roy Batty was "born" in the clas...

Science

It describes itself as "the leader in emotion detection and sentiment analysis ...

Celtic deny McGeady bid but pave way for Stokes exit

Rob Gronkowski, Stephen Gostkowski 1st-team AP All-Pro's

Check out the full list of First Team All-Pros at Pro Football Talk . This season, despite missing a game due to a bone bruise/sprained knee in Week ...

Constellation tops Q3 estimates, to build $1.5 billion brewery

The company had previously forecast adjusted earnings of $5-$5.20 per share and beer net sales growth of about 10 percent. Sales were up 6 percent t...

Calvin Ridley's younger brother will play for Kirby Smart at Georgia

Ridley helped guide Deerfield Beach to the 11-8A district championship and was a...

Golden State Warriors vs. Houston Rockets

HOUSTON, TX - DECEMBER 31: Dwight Howard #12 of the Houston Rockets steals the ...

Kane wants to stay at Tottenham - Pochettino

Harry Kane is one of the best strikers in Europe or in the world", Pochettin...

Health

Following the completion of the transaction, the executive vice president now di...

Lamar, which has operations in St. Louis, is close to a deal to purchase Clear C...

Venezuelan opposition takes reins of National Assembly

82-year-old grandmother killed in brutal attack in the UK

An 82-year-old grandmother was battered to death with a rolling pin in her own home in what detectives have described as a "brutal" and "horrific" att...

Mamata Banerjee woos captains of industry at Bengal global business summit

She also claimed that Maoist violence has come down in West Bengal. The West Bengal government-organised business summit on Friday witnessed Delhi C...

French police shoot man attempting to enter Paris' Goutte d'Or station

A police bomb disposal robot appeared to be inspecting the body. The man is be...

Congress blames BJP for blocking passage of GST

Gohil's counter attack on BJP happened a day after the ruling party accused Cong...

Azim Premji 'Most Generous Indian' for Third Year Running

Azim Premji, who donated Rs 27,514 crore for education is the " Most Generous In...

USA

They say he was told several times to surrender. Troopers say that Clay knelt ...