Click to enlarge

Click to enlarge

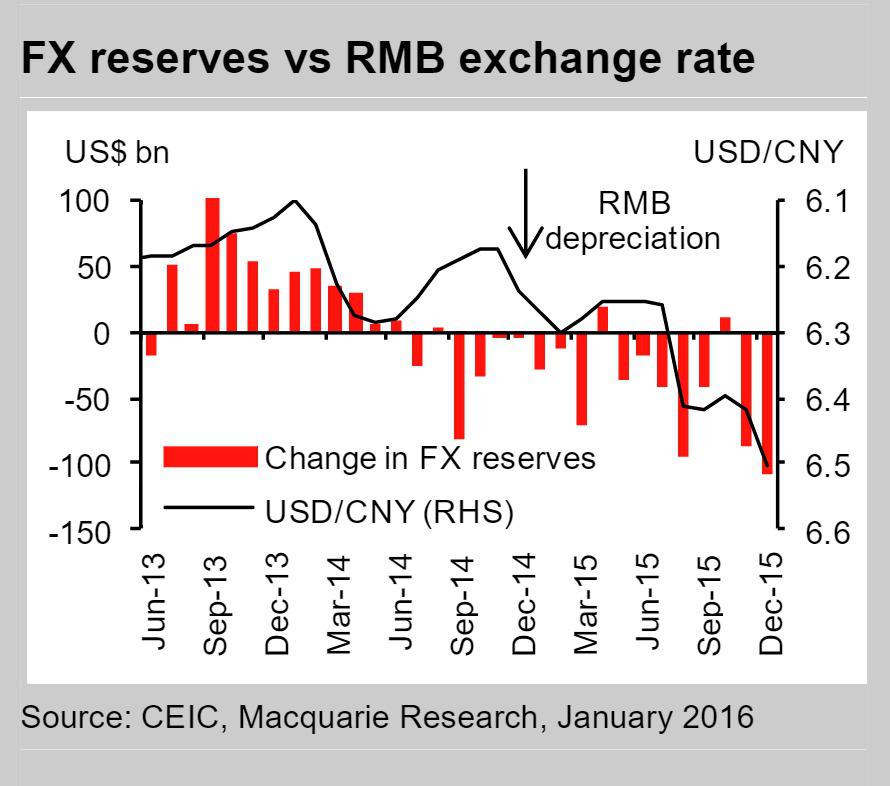

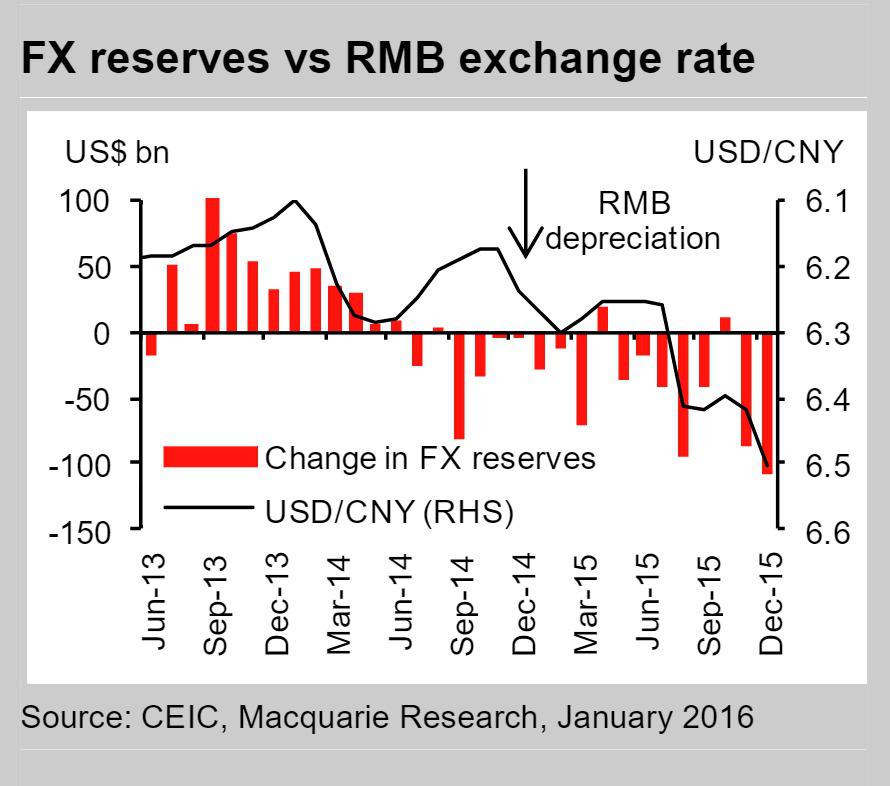

Markets in chaos amid widespread China fears

Click to enlarge

Click to enlarge

Dillon Hess

|

11 January, 2016, 01:00

Recommended

- Netflix internet TV network available in Serbia

- String of Storms Hitting California Due to Strongest El Niño on Record

- Azim Premji 'Most Generous Indian' for Third Year Running

- Chinese markets open higher after day's suspension

- Faraday Future Unveils 1000HP Concept Car, Investing $1 Billion On EV Facility

- Corps expects to open spillway to divert river water

- Jennifer Lawrence up for Best Actress in 'Joy'

- Great idea for horror film gets lost in 'The Forest'

- Callaway Cranks Out The 2016 SC600 Chevy Camaro

- Target collaborates with SoulCycle for a line of basic clothing, free classes

- VW exec sees US fixes soon in emissions test cheating

- Miss Columbia Agrees to a Sit Down With Steve Harvey

- Bill Belichick throws his support behind Chip Kelly the GM

- Mitt Romney: Ted Cruz 'natural born citizen'

- Manchester City on title track, believes Pellegrini

Trending Now

Dont Miss

Popular destinations

- Best Non Gamstop Casino

- Non Gamstop Sites

- Casino Not On Gamstop

- Casino Not On Gamstop

- Casino Online Non Aams

- Non Gamstop Casinos

- Sites Not On Gamstop

- Non Gamstop Casinos Uk

- Sites Not On Gamstop

- Non Gamstop Betting Sites

- Best Online Casino Canada

- Online Casinos Not On Gamstop

- オンラインカジノ 一覧

- Mejores Paginas De Poker

- Gambling Sites Not On Gamstop

- Casinos Not On Gamstop

- UK Casinos Not On Gamstop

- Non Gamstop Casino Sites UK

- Slots Not On Gamstop

- UK Online Casinos Not On Gamstop

- UK Casino Not On Gamstop

- Meilleur Casino En Ligne France

- Meilleur Casino En Ligne

- Casino Not On Gamstop

- Bookmaker Not On Gamstop

- Casino Non Aams

- Meilleur Casino En Ligne Belgique

- Jeux Casino En Ligne

- Casino Online Esteri

- カジノ 仮想通貨

- Casino Live

- I Migliori Siti Poker Online

- Casino En Ligne Avis

- Migliori Casino Non Aams

- 코인카지노

- Casino En Ligne Français

- Nouveaux Casino En Ligne

- Casino En Ligne France

- Casino En Ligne France